Energy Storage Update

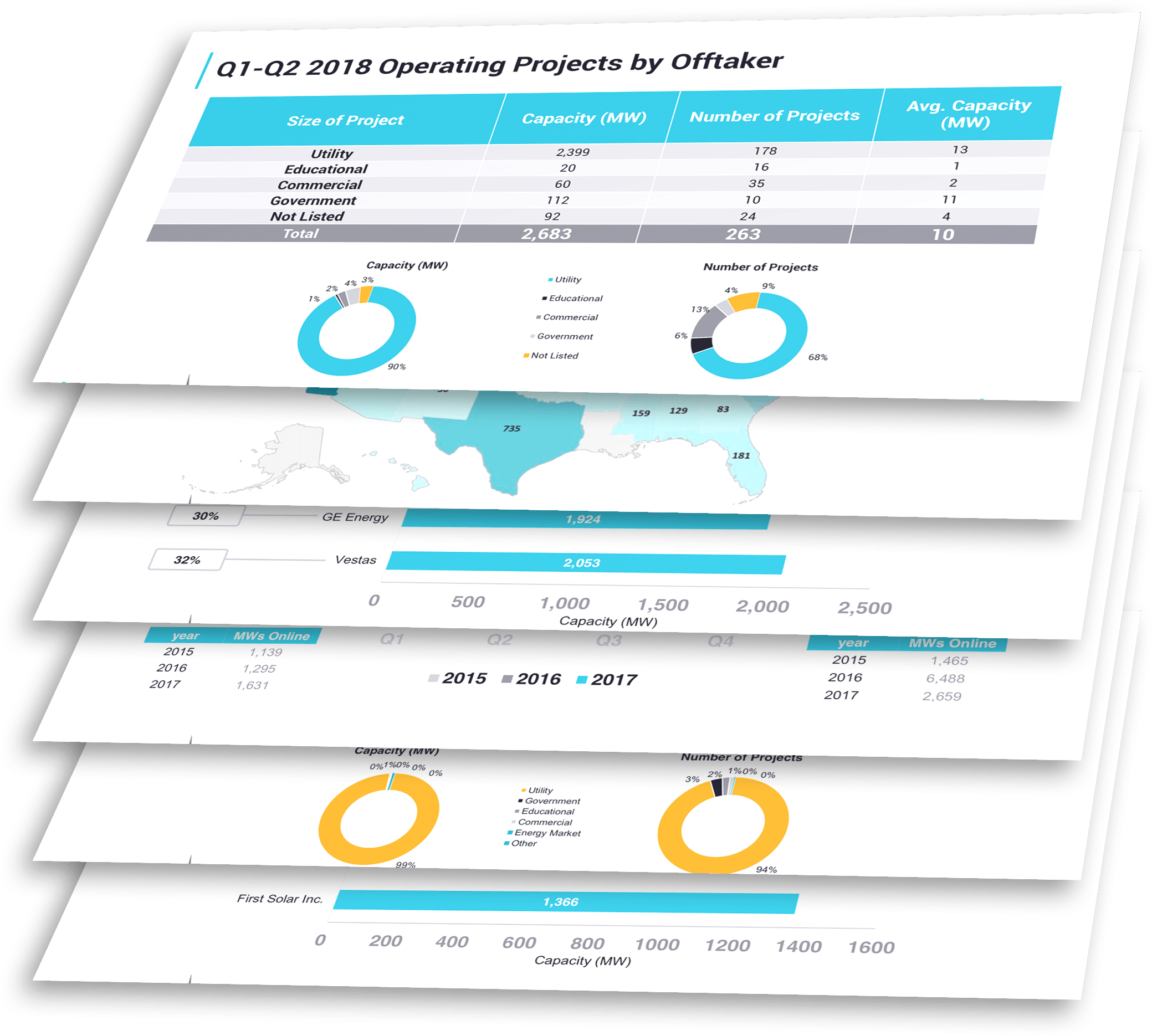

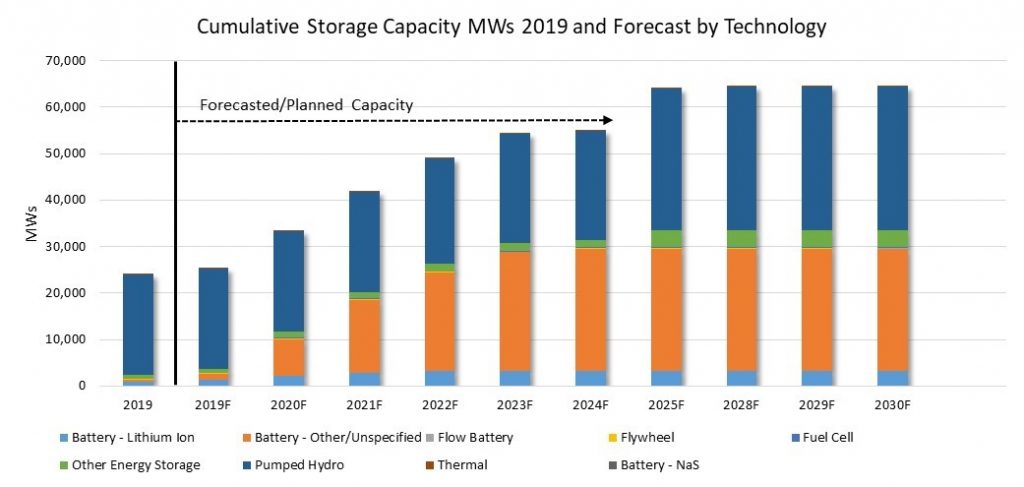

Storing electrons for later use is the holy grail of power sector dreams. Yet, energy storage, with all its pent-up promise, has faced challenges that have kept it relegated to the periphery of the power sector. That peripheral status creates a dichotomy; the one thing the industry most desperately needs is an economical and sustainable solution to meeting surges in power demand and yet that solution remains somewhat elusive. Total US/Canadian energy storage capacity crested 24,000 MW this month as tracked by Energy Acuity and we report here on the composition of a sector in flux. See Figure1, below.

It’s a fraction of what is needed to address reliability, congestion and sustainable market function and the next five years will see that capacity more than double to over 55,000 MW. Energy Acuity has been tracking energy storage and the rapid development of various technology types like wind, solar, smart grid, conventional generation, and energy storage as part of its regular information service for over 10 years. Energy Acuity, a Denver, Colorado-based energy information company, just entered its 11th year of business and is a leading provider of global renewable power market intelligence.

The market and economic circumstances impacting energy storage looks poised for a change. If you’ve been in the power industry for a while, you will no doubt think you’ve heard that before. Granted there have been a number of false starts with all sorts of technology in the power sector, and these false starts to create knock-on complications in policy, incentives, financing, and adoption. Storage too has seen similar false starts and yet the sun appears to be rising on its fortunes.

Figure 1: North American Storage Capacity Additions by Year. (Above 0.5MW) Source: Energy Acuity, LLC

Buoyed By Need

Storage is still a bit of a niche to have in North American power markets. It’s been slower to catch on because the technology has not been able to capture meaningful economic benefit like other kits. Instead of storage, North American power markets have opted to build-out the conventional wires/grid system to meet burgeoning peak demand. While that may satisfy utilities’ angst, it has created a mass of operational debt that hangs millstone-like around their necks.

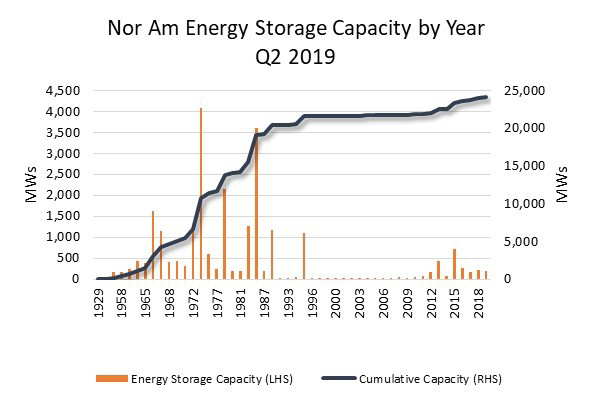

Figure 2. North American Energy Storage currently operating by technology. Source: Energy Acuity, LLC

Science Me Up

Recent advances in chemical substrate, metal doping, and other physical property science, has sped advances in battery technology. This, in turn, is driving down the costs, making batteries competitive with other forms of energy storage. Lower cost and higher efficiency (relatively) over other types of storage are capturing interest. That by itself would perhaps be enough to propel storage to energy superstardom, yet its uptake has been challenged by energy policy.

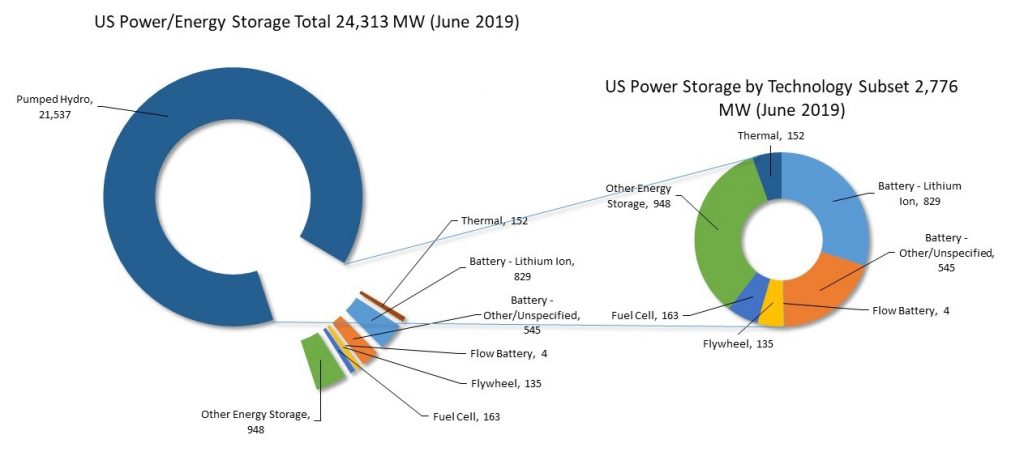

Figure 3. Nor Am Cumulative Energy Storage by Technology by Year. Operating minus Pumped Storage. Source: Energy Acuity, LLC

A peek at storage projects coming online over the next decade speaks directly to the changing status of storage and the reduction in the cost of implementation. Costs for battery storage have dropped from $2,300/kW in 2016 to $1,800/kW in 2019 and are now on par with some pumped storage facilities. Unlike pumped storage, battery systems can be put into operation in a fraction of the time. The average project timeline for pumped storage is 2-3 years for siting and permitting and an additional 4-5 years to build. Contrast this to 1 year for permitting and siting and up to 12 to 18 months for building a battery energy storage system. With costs/kW being almost equal perhaps it is not surprising that battery storage systems are being added at 2.75 times the rate of pumped storage. See Figure 4.

Figure 4. Nor Am Cumulative Energy Storage capacity forecasts by technology. Source: Energy Acuity, LLC

What The FERC?

Recent modifications to regulatory policy by the Federal Energy Regulatory Commission (FERC) work to limit restrictions on how energy storage may be considered in markets and expands the economic range in which these assets can work out economically. While this has greatly expanded the fortune of energy storage, it pits regional transmission organizations and the independent system operators against the FERC. For example, while FERC Order 841 addresses energy storage directly allowing it to move into wholesale markets, it also pushes RTOs and ISO’s like the MISO and the SPP to come up with rules for how energy storage can participate in wholesale markets for electricity. These rules must address energy, capacity and ancillary services markets.

If that wasn’t enough to exasperate ISO’s and their members, FERC’s Order 845 outlines ten market reforms including reclassifying generators to include energy storage and reducing the large generator requirement for interconnection. This allows companies to apply for interconnection at capacities lower than the nameplate capacity of the generator. This is great for wind, solar and energy storage assets because it’s harder for these assets to successfully generate at their nameplate capacity.

“Houston We Had A Problem”

Now that the electric power industry has reached a middle age of sorts, collective awareness and reflection is changing conventional thought on how to deploy generation and energy storage. The power sector’s conventional wisdom was based on how to address the lumpiness of supply and demand which caused the industry to plow on, building large centralized power plants and massive transmission systems to ensure there was more than enough power available all the time.

The Answer My Friend

Wind turbines and solar plant produce electricity at staggeringly low cost. That is part of the appeal. The rest is the renewable nature of the power, the elimination of particulate pollution, and sustainability of these types of generation. Renewable Portfolio Standards (RPS) have encouraged investment in wind and solar driving market prices negative in some regions. The Achilles heel for renewables and the more widespread adoption of the technology is intermittency of wind and sun. Batteries in combination with renewable assets can eliminate that weakness and together with FERC policy the economics of both energy storage and renewables have shifted.

Energy storage is an interesting thing. It is part technological marvel and part suspension of belief. The possibility of storing electricity in significant quantities to do anything meaningful has eluded physicists until recent times. Sure we have managed to store water for later release in a brute force approach but pumped hydraulic storage is hugely capital intensive and risky. But with advances in technology, in material science and in some cases brute force engineering, it is possible to store enough energy to release it again with interesting results.

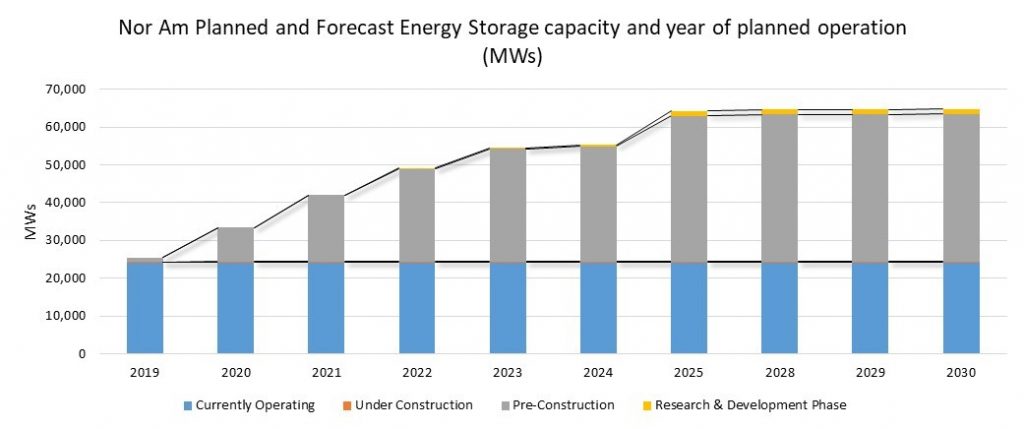

Figure 5. Planned and Forecasted Capacity Additions by Planned On-line Year. Source: Energy Acuity, LLC

Pump You Up!

Indeed, a three to four-decade push focusing on pumped water reservoir storage peaked in the early 1970s but had run its course by the mid 1990s. See Figure 1. This was due in part to; issues in gaining licenses from the Federal Energy Regulatory Commission (FERC), environmental considerations, economics and suitability of geologic terrain. But it was the cost of building pumped storages facilities that were a real issue, even modest ones ran into the tens of millions of dollars. Cost notwithstanding, some regulatory jurisdictions did approve pumped storage projects despite the cost. One example is Ludington, a massive 1,875 MW beast that in 1973 cost over $300 million to build and is almost done with an $800 million upgrade[i] to boost it to 2,172MW. That should be completed later this year and the jointly owned (Consumers Energy, 51% and DTE Energy, 49%) Ludington Pumped Storage facility in Ludington, Michigan is wrangling completion and license extension and relicensing as its current license expires June 30th of 2019. Ludington represents a lump of capacity, one of tens of thousands of MWs of pumped storage capacity that was built in the early 1970s when growing populations and power demand spiked a need for additional peak load. That need was enough of a push to prompt the pursuit of over 21,000 MW of pumped storage plants to tackle things like mid-day power congestion.

A similar need is prompting a planned 44,000 MW of energy storage capacity to come online by 2030, that includes 9,000MW of pumped storage and a lot of batteries. See Figure 5. Companies are not sure exactly when these projects will be switched on hence the gap in online dates between 2025 and 2028, but their plans show how the landscape will change over the next few years. Granted it may not all get built, but is a clear indication of how energy storage is going to support renewable and conventional resources.

Michael Carter

mcarter@energyacuity.com

720.235.1291

Download This Report: 2019 Energy Storage Update (PDF)

Source: Energy Acuity, LLC

About The Author

Michael Carter, Energy Acuity’s Chief Revenue Officer, has over 20 years in the power intelligence and generation space. Michael brings in-depth expertise in data and information analysis, analytic tools from development to complex, and energy, electric power, and mining market-based industries.

Additional Reading:

New Jersey Final Report on Energy Storage

Federal Energy Regulatory Commission Order 841

Federal Energy Regulatory Commission Ode 845

[i] https://www.consumersenergy.com/residential/renewable-energy/green-generation/the-power-that-surrounds-us